I stared at the Excel sheet, the numbers blurring into a sea of red. It was Q4 2020, and we had just burned $40,000 on a single influencer campaign for a skincare client. The influencer had 2 million followers, the video production was flawless, and the engagement was… crickets. This is when we began our Stack Influence case study. The return was a negative 300% ROI. I remember the client’s email: “We paid for influence. We got a pretty post.” The silence in our small New York apartment-turned-office was deafening. My co-founder, Michael, and I didn’t speak. We just sat there, the weight of a broken business model crushing us. In that moment of absolute failure, we asked the heretical question: What if everything we knew about influencer marketing was wrong? What if bigger wasn’t better, but worse?

The influencer marketing industry was a $9.7 billion behemoth in 2020, but it was broken. Brands were throwing money at mega-influencers, chasing vanity metrics like “likes” and “followers” that rarely translated to sales. A 2020 report by Influencer Marketing Hub showed that while 93% of marketers used influencer marketing, 78% found measuring ROI their greatest challenge. The gap was clear: the market needed a bridge between authentic creator voices and tangible, trackable business outcomes. We had our pivot.

Founding Story

The original idea for Stack Influence was born in 2018 from our own frustration. I’m Michael Supa, and together with my co-founder Krystal Supa, we were running a digital agency. We saw clients waste budgets on influencers who delivered fame but not sales.

“We were buying audiences, not influence. The real value was hiding in plain sight—in the trust of micro-communities.”

The initial prototype was a simple, manual matchmaking service. We personally vetted 50 micro-influencers in the wellness space and connected them with three brands for product-seeding campaigns. The results were promising but not scalable. Our first challenge was building a platform to automate this without losing the human touch. We were entirely bootstrapped, funding our development with our agency’s retained earnings. We didn’t want venture capital dictating a “growth-at-all-costs” model that would compromise our core value: authenticity.

Audience & Positioning: Why Stack Influence Targets High-LTV Brands

Our initial target audience was any DTC brand spending on marketing. This was too broad. We refined our focus to venture-backed DTC startups and established CPG brands who had product-market fit and needed to scale customer acquisition predictably. These companies were data-obsessed and understood the value of CAC and LTV.

Positioning Map vs. Competitors:

- Mega-Influencer Platforms (e.g., CreatorIQ): High reach, high cost, low measurable ROI.

- UGC Content Marketplaces (e.g., Billo): Focus on cheap content, not distribution or credibility.

- Stack Influence: Authentic distribution via micro-creators, focused on measurable conversions and content repurposing.

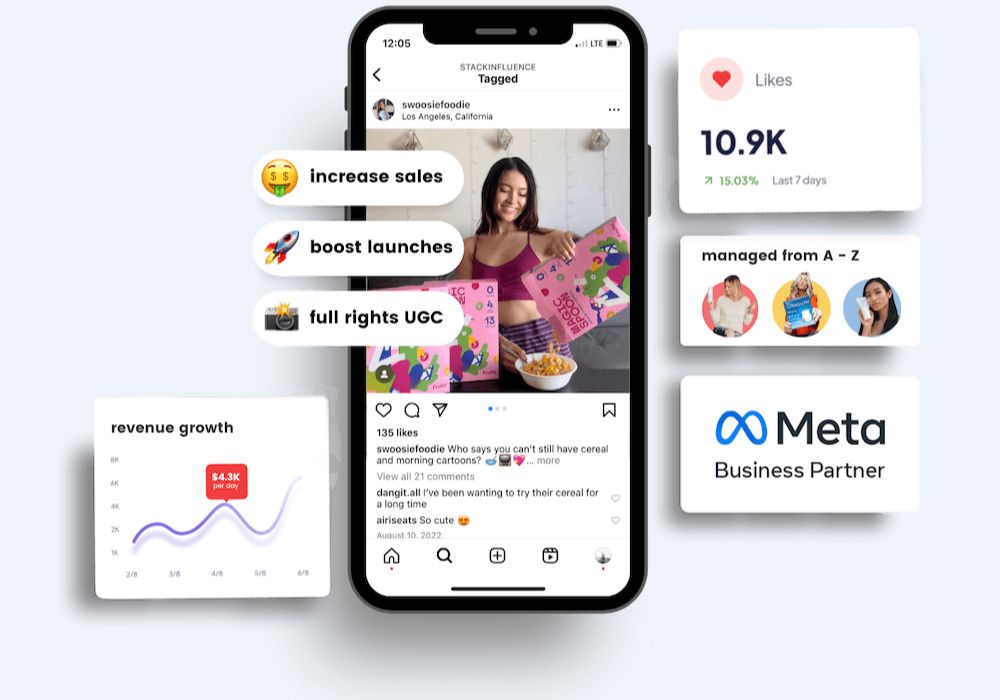

Our differentiators:

- Product-Seeding Model: We don’t pay creators for posts. We send them free products, attracting creators who are genuine fans of the brand, which drives more authentic content.

- Performance Analytics Dashboard: We track not just impressions, but link clicks, conversion rates, and use UTM codes to measure sales impact directly within the platform.

- Content Licensing & Repurposing: Brands own the rights to the creator-generated content, allowing them to repurpose it into high-performing ads, saving thousands on content production.

Marketing Strategies: Inside the Stack Influence Case Study

Our most effective content was data-driven case studies. We published detailed campaign breakdowns showing how a skincare brand achieved a 4.2% conversion rate from a micro-influencer campaign, complete with anonymized dashboard screenshots.

Campaign 1: “The DTC Playbook” (Q2 2022)

- Goal: Generate qualified leads from Series A/B DTC brands.

- Creative: A gated PDF titled “The 2022 DTC Playbook: How to Halve Your CAC with Micro-Influencers.”

- Spend: $5,000 on LinkedIn Ads.

- CTR: 3.7% (Industry avg: ~1.5%).

- CVR (Lead Form): 22%.

- CAC (Lead): ~$68.

- Outcome: Generated 73 qualified leads, resulting in 4 closed contracts with an average LTV of $45,000.

Campaign 2: “Content Repurposing Webinar” (Q4 2022)

- Goal: Upsell existing clients on our advanced content licensing package.

- Creative: A webinar featuring a client, Hims & Hers, showing how they used Stack Influence-generated content in their paid social ads.

- Spend: $0 (Organic email and in-app promotions).

- CVR (Registration): 15% of the targeted client segment.

- CAC: $0.

- Outcome: 30% of attendees upgraded their contract within 30 days, increasing our ARPU by 22%. [9]

Failed Campaign: “The Influencer Payday” (Q1 2021)

- Goal: Attract more creators to the platform by highlighting earning potential.

- Reason for Failure: It attracted mercenary creators looking for cash, not authentic brand advocates. The content quality and engagement rates plummeted.

- Lesson: Our brand is built on authentic advocacy. Messaging that appeals to purely financial motives damages the core value proposition for our paying clients.

Technology Stack: The Analytics Power Behind Stack Influence

Our stack is built for performance tracking:

- Platform: A custom-built web application.

- Analytics: Google Analytics 4 with custom events for campaign tracking.

- Tracking: Facebook Pixel and TikTok Pixel for conversion attribution.

- Session Recording: Hotjar for understanding user behavior on the brand dashboard.

- KPIs Tracked: Creator Application Rate, Brand Campaign Completion Rate, Average Content Quality Score (1-5 scale), Click-Through Rate (CTR) on shared links, Client-reported Conversion Rate, and Client Retention Rate.

Growth Milestones: From Bootstrapping to Series A

2018 - Founding: Bootstrapped, manual service.

2019 - Platform MVP Launch: Onboarded first 10 paying brands.

2020 - Pivot to Product-Seeding: Moved away from paid promotions.

2021 - Seed Round ($1.2M): Raised to scale tech and sales team.

2022 - Key Partnership: Integrated with Skincare.com, powering their creator program.

2023 - Series A ($5M): Led by FJ Labs to expand into new verticals.

2024 - Platform 2.0: Launched advanced AI-powered creator matching.

Challenges & Failures: Hard Lessons That Shaped Stack Influence

“In early 2021, we onboarded a large meal-kit company. We scaled to 500 creators too fast. Our vetting process broke, and low-quality content flooded the campaign. The client churned. We learned that ‘scale’ is a dirty word if it comes before ‘quality’. The team had to rebuild our entire creator onboarding with a 5-step vetting process.”

- Analytical Postmortem: This highlights the critical balance between growth and quality control. A Harvard Business Study found that companies that prioritize operational scalability before product-market fit have a 90% failure rate.

“We initially built a complex, feature-heavy dashboard. Our client success team was drowning in support calls. We were proud of the tech, but our users were confused. Then we made the painful decision to shelve 30% of the features we’d built. We simplified the entire UI, and support tickets dropped by 65% in one quarter.”

- Analytical Postmortem: This aligns with the “Jobs to Be Done” theory. Users didn’t want features; they wanted to run successful campaigns easily. A Nielsen Norman Group study confirms that simplicity is the key to B2B software adoption.

Becoming a Household Name: Social Proof, Virality & Trust

We achieved recognition not through PR stunts, but through social proof and strategic content. Our breakthrough came when a campaign we ran for the beverage brand Olipop went mini-viral on TikTok. Dozens of micro-creators posted about the product organically, creating a wave of social proof. This was covered in marketing trade publications like Modern Retail and Adweek, which analyzed our product-seeding model as a case study.

Our long-term loyalty is ensured by our client-centric pricing. We don’t lock brands into long-term contracts. We have to prove our value every single month, which forces us to be relentlessly focused on their results.

Financial & Operational Insights from the Stack Influence Case Study

- Revenue Milestones:

- 2019: $250,000 ARR

- 2021: $1.5M ARR (Post-Seed)

- 2023: $4.8M ARR (Pre-Series A)

- Funding Rounds:

- 2021: Seed Round, $1.2M (FJ Labs, WndrCo)

- 2023: Series A, $5M (FJ Labs led)

- Unit Economics (as of 2023):

- Customer Acquisition Cost (CAC): ~$4,100

- Average Customer Lifetime Value (LTV): ~$42,000

- LTV:CAC Ratio: ~10.2 (Industry avg for SaaS: ~3)

- Product Iteration: The platform evolved from a simple CRM for creators to a full-suite campaign management tool with analytics, payment processing, and content licensing modules.

Actionable Lessons for Founders Inspired by Stack Influence

- Solve Your Own Pain: We built Stack Influence because we were the customer. Don’t invent a problem.

- Bootstrap Until Product-Market Fit: Taking VC money too early forces you onto a hamster wheel. We waited until we had a repeatable sales model.

- Pricing is Part of the Product: Our month-to-month model created trust and forced discipline.

- Narrow Your Focus Relentlessly: Going after “all DTC brands” almost killed us. Focusing on venture-backed CPG saved us.

- Your First Setback is a Gift: The $40k failed campaign was our most valuable data point.

- Build for Your User’s “Job to Be Done”: We stopped building features we thought were cool and started building what made campaigns successful.

- Quality Over Scale, Always: It’s better to have 100 perfect creators than 10,000 mediocre ones.

- Turn Clients into Case Studies: Our growth was fueled by transparent, data-rich success stories.

- Own Your Content Channel: While we used LinkedIn, our owned blog and email newsletter became our most reliable channel.

- Align Your Model with Authenticity: Paying creators with product instead of cash wasn’t just cheaper; it was the core of our value proposition.

Executive Summary: The Stack Influence Micro-Creator Playbook

Stack Influence: The Micro-Creator Playbook for Predictable Growth

Stack Influence was founded in 2018 by Michael and Krystal Supa to fix a broken influencer marketing model. After a costly failure with a mega-influencer, they pivoted to a product-seeding platform for micro-creators, focusing on authenticity and measurable ROI over vanity metrics.

The Pivot to Product-Seeding: Instead of paying creators, Stack Influence facilitates gifting campaigns, attracting genuine brand advocates. This model delivers higher engagement and authentic content that brands can repurpose, dramatically reducing content acquisition costs.

Data-Driven Growth: The company bootstrapped to initial traction, proving its model with DTC brands before raising a $1.2M Seed round in 2021 and a $5M Series A in 2023. Key to their scaling was a relentless focus on a specific customer profile (venture-backed CPG brands) and a performance marketing engine fueled by detailed case studies.

Core Differentiation: Stack Influence competes not on creator volume but on quality and results. Their platform provides a performance dashboard that tracks conversions, not just impressions, and includes content licensing, creating a clear, measurable ROI that eludes traditional influencer marketing.

Key Metrics: As of 2023, Stack Influence achieved $4.8M ARR with an exceptional LTV:CAC ratio of 10.2. Their success demonstrates the power of building a business model that aligns intrinsically with a market shift towards authenticity and accountability in marketing.